Contents:

Both sales and earnings are critical factors in the success of a company. Companies with quarterly EPS or revenue growth of over 1,000% were excluded as outliers. Companies with quarterly EPS or revenue growth of over 2,500% were excluded as outliers.

No signs of OZ Minerals slowing down as BHP takeover looms – The Motley Fool Australia

No signs of OZ Minerals slowing down as BHP takeover looms.

Posted: Fri, 14 Apr 2023 02:13:29 GMT [source]

That figure could increase after positive initial data from the company’s Mason Copper project in Nevada. “Shares of Colorado-based Newmont, the largest gold miner in the world, experienced weakness in the quarter as falling gold bullion prices and cost inflation hurt miners in general. Copper is the third most used metal in the world with Chile as its biggest producer and China as its biggest importer.

OZ Minerals Ltd (OZMLF)

The company initially invested $14B in the copper mine back in 2018 with a permit to mine until 2041, and an extension request this early could indicate they found much more copper than expected. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Barclays Capital-owned iPath runs the exchange-traded note iPath Bloomberg Copper Subindex Total Return.

This is an increase of 13% compared to the dividend of last year. Put simply, the stock of the Southern Copper Corporation is a good option for those looking to find a form of passive income in the stock market. Out of the 25 hedge funds currently investing in the Rio Tinto Group, Fisher Asset Management is the largest with over 12.5 million shares worth more than $971 million.

It could increase its copper output by five-fold over the next decade as it continues expanding its mining capacity. A rising market price suggests strong economic health, while a decline suggests the opposite. Since the start of 2022, copper has seen historically high prices. In Q1 and most of Q2, copper prices on the COMEX ranged between US$4.10 and US$4.89 — an all-time high. For the same time period on the LME, copper moved between US$9,000 and US$10,730. Q3 has brought lower prices for the metal, which has seen year-to-date lows of US$3.21 and US$6,998, respectively.

Cryptos to Buy to Bag Big-Time Returns in Q2

If international exposure is important to you, it should be noted that the fund is heavily weighted to North American companies (about 40%), and is balanced semi-annually. Russia’s war with Ukraine makes the company’s access to potash a compelling reason to buy the stock. And the company plans to increase its capital expenditure to meet the global demand for copper. This makes BHP stock a compelling choice for investors looking to benefit from undervalued stocks that offer the benefit of international exposure.

4 Best Copper Stocks To Buy Now in 2023 – GOBankingRates

4 Best Copper Stocks To Buy Now in 2023.

Posted: Wed, 01 Feb 2023 08:00:00 GMT [source]

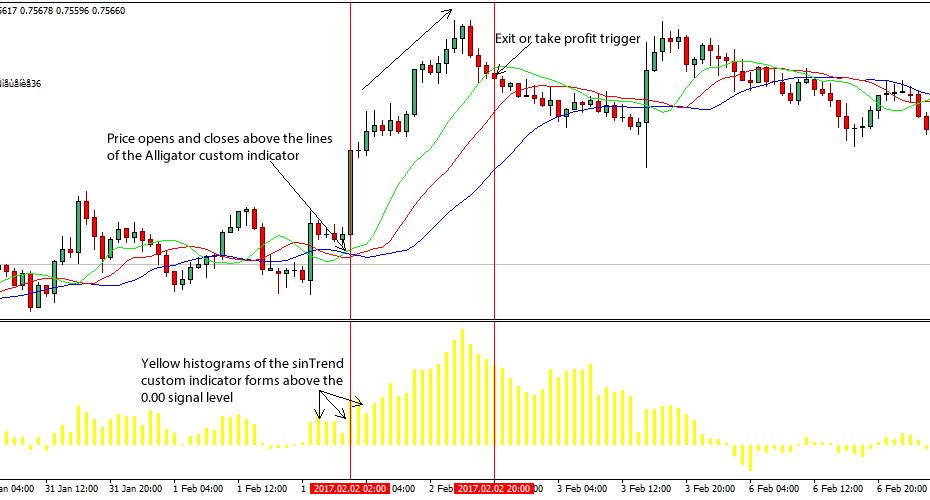

You must be aware of the risks and be willing to accept them in order to invest in the Forex, Stocks, Commodities,Futures, Cryptocurrencies, and CFDs markets. The financial information, news and research that you may receive from Top1 Insights for educational and informational purposes only and is not trading, investment, or advice. You should seek your own investment advice from an independent certified financial adviser if you have any doubts who will consider your personal objectives and circumstances.

Southern Copper prides itself as the lowest-cost copper miner globally. However, Southern Copper expects its copper production to be below that level in 2021 and 2022. The company expects its copper production to recover to 1 million metric tons by 2023 and then gradually rise to 1.9 million metric tons by 2028. The latest financial reports included highlights such as 2021 revenue exceeding 2021’s by a staggering 72% and record profits of $21.4bn.

Why are experts predicting a rise in copper prices?

The company’s share price has risen in December, reaching an H2 high of C$2.64 on December 13. The company’s most recent news was the release its third quarter results, which include further discussion of those topics, as well as Rio Tinto’s acquisition of Turquoise Hill Resources. The company’s share price has been elevated since late October, and on December 12 it matched its previous year-to-date high of C$1.17. In late November, new assays shared by the company included a large interval of 1,313.2 meters grading 0.65 percent copper equivalent. On September 5, Turquoise Hill signed a definitive agreement with Rio Tinto at that price point.

- Dividend investors might also be interested to know that the company offers a dividend yield of 11.88% -making for an attractive option for passive income if for nothing else.

- Trading copper stocks means you’ll speculate on the share price of companies linked to copper in some way, for instance mining companies like the ones listed above.

- Has provided almost 110% returns on investment over the past 12 months.

Its main outputs include https://forex-world.net/, iron ore, nickel, petroleum and coal. The miner has a rich history, which dates all the way back to the late 1800s. Although share prices took a hit during the pandemic, Southern Copper still managed to provide returns of 64% to investors over a 12-moth period. And with the pandemic slowly winding down, capitalizing on the stocks of this company might be as important now as ever. Its shares gained a full 5% amid the hectic climate of the gold and mineral stock markets. Income investors might also be happy to hear that the company offers a dividend yield of 3.66%, making it an ideal investment option for the long haul.

Commodity prices can be highly volatile, but whilst the risk of price moving against is very real, you can ensure that the broker you use to manage your account is trusted. The EV manufacturerssuch as Tesla and other renewable energy firms, which are sprouting up in the US, require secure supplies of the metal to make their products, and FCX certainly ticks that box. Freeport-McMoRan is one of the world’s largest publicly listed producers of Copper.

Motley Fool Returns

Apart from copper, the Barrick Gold Corporation, as the name implies, also specializes in the mining of gold. With operations in about 10 countries, there’s no question that this company has a diversified portfolio. The stocks of companies that don’t have all their eggs in one basket are generally more stable and dependable. Additionally, the company’s fundamentals suggest that it’s an undervalued choice as well. The company’s P/E ratio of 5.7-times is low, even in a sector where P/E values tend to average below 10-times earnings.

Results from the most recent drill program have been spectacular. I expect higher gold, copper and silver prices in 2021 and Chakana provides excellent exposure to those commodities. Trading financial products carries a high risk to your capital, particularly when engaging in leveraged transactions such as CFDs. It is important to note that between 74-89% of retail investors lose money when trading CFDs.

Some investors own the copper bullion, while others do not own copper but trade it indirectly through company shares, ETFs, futures, or options. When formulating this list, the ethical and environmental concerns played a role in our methodology, and we aimed to include copper stocks with transparent ethical practices. Like any stock, copper stocks can sometimes be susceptible to media limelight and broker hype.

5 Best Copper Stocks for a Green Future – Investor Junkie

5 Best Copper Stocks for a Green Future.

Posted: Wed, 14 Dec 2022 08:00:00 GMT [source]

Sector growth is almost guaranteed — With copper playing an essential role in green energy development, a rise in global demand is all but certain. Profits are way down in 2022 as the company depletes some of its current reserves and focuses on expanding its existing operations in Mexico and Peru. The company has also begun exploration activities in Argentina, Chile, and Ecuador, which could yield significant fruit in the long term.

Are There Benefits and Risks to Investing in Copper Stocks?

If Best copper stocks stays at $4 per pound, Freeport-McMoRan expects an EBITDA of $12 billion on average in 2022 and 2023. Looking at the growth outlook, FCX stock is attractively valued even after the surge. We’re now only six months away from scheduled initial production at Kakula, but already Ivanhoe has begun underground development. The company reported stockpiling some 269,000 tonnes of high-grade copper ore. All-in sustaining costs are in the mid $900s, down from over $1,000 an ounce.

In fact, holding commodities in your portfolio can help offset the effects of inflation. Over the long-term, government policies surrounding EVs in the U.S. will likely drive up the price of copper by increasing demand. GMT Capital had the most prominent stake in the quarter with over 30.99 million shares worth $125.9 million. As you can see by the over-the-counter designation, this is a penny stock, but one that may be worth considering as part of a broader precious metals portfolio.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Investors may learn more about a potential earnings slowdown when the company reports earnings in early November. This gives the company several potential revenue streams, and the company clearly believes that copper is one of them. In fact, the company cited the S&P Global study mentioned in the introduction to this article in offering a bullish outlook for copper demand in the next 10 to 15 years. That’s significant because at this time, investors should be prioritizing quality when considering which stocks to hang onto for the long haul.

Pan American pays a dividend of 7 cents a share; that dividend is projected to rise 15% per year for the next three years. So, we’ve got growth, a potential massive silver mine coming online, silver and gold and it’s a dividend raiser. Buy this on any dip, and it should be much higher a year from now.